- Next TMT

- Posts

- Disney and Amazon impose their bundling will, T-Mobile fumbles 'cell-phone internet,' and 'the monster of all media,' YouTube, grows some more

Disney and Amazon impose their bundling will, T-Mobile fumbles 'cell-phone internet,' and 'the monster of all media,' YouTube, grows some more

Our weekly newsletter covering all things technology, media and telecom also celebrates a rare week of spinal stability for the news business

In partnership with

You can also listen to all of our audio podcasts on Spotify.

A big week for the ‘Great Re-Bundling’

Atomized into hundreds, if not thousands, of video choices by streaming’s veritable “Big Bang,” it does appear the video business is experiencing what physicists call a “Big Crunch” — a universe collapsing back upon itself, back to where it all started.

Among non-scientists, some of the pointy-headed navel gazers who fill our LinkedIn feeds with clever mashups of Nielsen data refer to this as “The Great Re- Bundling.” (That term always makes us think of Charlie Brown holiday specials.) Whatever you call it, it was certainly on last week.

Disney expanded its landmark 2023 carriage deal with Charter Communications, adding Hulu with Ads to the robust collection of SVODs the cable operator already delivers to Spectrum Select subscribers at no additional price. The original deal was billed as such a win for Charter — not only did CEO Chris Winfrey’s team secure Disney+ and streaming ESPN+ for the popular Select tier, but the narrative painted them telling Disney to pound sand on lesser networks including Disney Jr, Disney XD, Freeform, FXX, FXM, Nat Geo Wild, Nat Geo Mundo and BabyTV. With the expansion deal, those channels are back in the Select bundle. In addition to more than 150 linear channels, Select now delivers all the major streamers, save Netflix and Amazon Prime Video, at a cost well north of $100 a month, when you tack on taxes and fees.

DirecTV, meanwhile, secured the missing link for its “Genre Packs,” skinny bundles (well, svelte anyway) themed around sports, entertainment, news and now kids’ programming, with Paramount Global the last major Hollywood conglomerate to fall into line.

Starz and Hallmark Plus, which already receive much of their distribution via Amazon Prime Video Channels, bundled their offerings on the platform, discounting the combined price by $4, to $14 a month, for subscribers who take both.

Notably, Amazon flexed its Prime Video Channel muscles at last week’s Engage 2025 event in Culver City, Calif. Research company Antenna presented data at the conference showing subscription streamers, on average, get 5.6 million more customers by bundling with Prime Video Channels versus not doing so, an 89% bump.

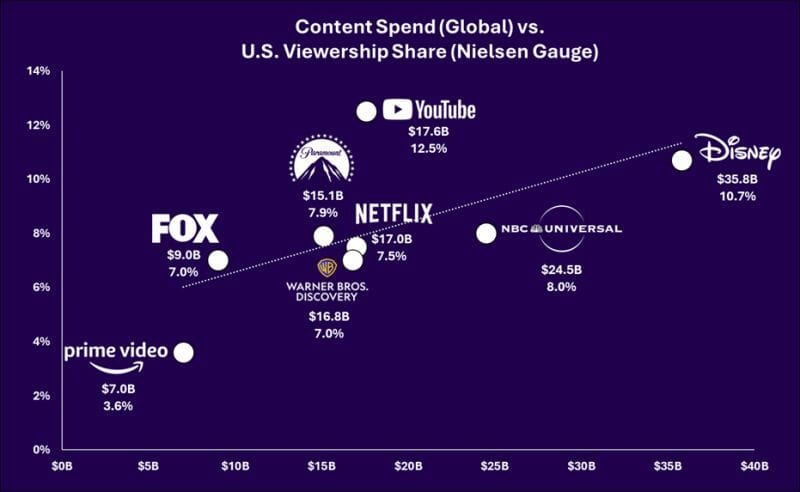

Prime Video Channels uses third-party content to help Amazon drive a meaningful portion of usage on its platform, while spending less on its own content than competitors do, as this Nielsen data mashup from Roku Head of Subscriptions Michael Gross reveals.

X-axis-ing content production spending versus Nielsen’s tally of aggregate U.S. viewership share, it’s probably good to hug that Y axis, as Amazon does. chart courtesy of Roku’s Michael Gross.

— Daniel Frankel

We’re Here to Make TV Better. For Everyone

Ventura is a smart TV OS, designed to drive a fairer and more sustainable streaming ecosystem for OEMs, Operators, Retailers, and Media Publisher.

Ventura unlocks new revenue streams for OEMs, operators and retailers, optimizes advertising impact for brands, and helps streaming services fund the next generation of great shows, movies, and news. Above all, it places the viewer at the center, ensuring a seamless and captivating journey that sets a new standard for the future of television.

Customize Ventura to reflect your business strategy and brand. Flexibility to integrate with your existing content, services, and membership options to create a unique customer experience that elevates your brand and keeps customers engaged.

Ventura helps publishers grow on their own terms. From monetization and audience acquisition to brand equity and retention, we give you the tools to scale your business, without conflicts of interest, platform interference, or competing agendas.

Learn more by visiting VenturaTVOS.com

Next Text: Big Cable finally gets a handle on FWA, Dana Walden and Disney run down the clock on Charter, and Gavin Newsom seeks Dominion-like money from Fox News

Our weekly text exchange between veteran reporters David Bloom and Daniel Frankel also examines the resounding triumph of free streaming and the indomitable obstruction of James Dolan

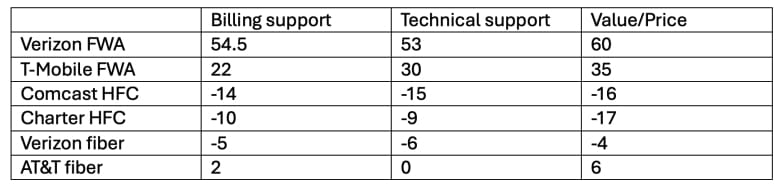

DANIEL FRANKEL: Happy pre-holiday, David. I’ll just jump right in with the culmination of our year-long trial of T-Mobile’s $50-a-month fixed wireless access 5G home internet. My conclusion: The shitty performance and terrible customer service don’t justify the substantial savings versus cable. One of my college-student sons is changing apartments in Santa Barbara in the fall, and I was trying transfer his FWA service to his now former roommate, who is staying in the old place and still wants to use the service … even though Reece did nothing but bitch about the network performance. We left the modem 90 miles up the coast when we moved Reece out last week. But it wasn’t until I talked to literally my seventh T-Mobile customer service rep — finally, one with at least a vague familiarity with the home internet product — did I find out I need the modem with me to make the transfer. With the boys vacated to various far-flung college baseball points of call this summer, I now have to drop everything and drive back up to SB to pick up the modem, all because T-Mobile can’t get its shit together. Truthfully, even as a wireless customer a few years ago, I always found my interactions with T-Mobile’s reps (also far-flung) maddening. Yet, their Net Promotor Score kills cable. In fact, all of FWA kills cable on NPS. My experience with Charter for wireless and home internet has been so much better. I honestly don’t get it.

Courtesy of Fierce Network based on Recon data.

As I head up the coast, I’ll listen to the fast-rising Parker McCollum’s new LP. (When provocatively Q&A’d by the newly christened Southern California Entertainment Journalist of the Year as to which songs on the album he’s “most proud of,” this title was among the 14 tracks the Texas country rocker selected. Feel like I know him better now.)

DAVID BLOOM: It’s so sweet to watch the child as teacher to parent, not just about the outrages and ineptitudes of massively successful T-Mobile (shares up 32.7% in the past year), but also of young country stars profitably (and enjoyably) mining blue-collar musical territory first carved by the Eagles and Bob Seeger half a century ago. While you’re at it, pull up Mott the Hoople and Bad Company, two bands graced by the gutty guitar work of Mick Ralphs, who just died. Have a lovely drive. I spent much of Friday at the chock-full-o’-goodness UCLA Entertainment Symposium, hosted by their law school and therefore also chock full o’ lawyers stocking up on MCLE credits and schmooze opportunities. Among the few noteworthy bits that keynoter and Disney heiress-apparent Dana “I’m just trying to run down the clock” Walden let slip through her perfectly tended lips Friday was what she called that “interesting” new version of the groundbreaking Disney-Charter deal. Now, Charter subscribers get Disney+, and Hulu, and all those formerly endangered digi-nets targeting demographics such as toddlers. Her focus was helped immeasurably by grandfatherly interlocutor Ken Ziffren, a conference sponsor and long one of Hollywood’s most powerful entertainment attorneys but, importantly to explain why she took the stage in mid-Disney succession, also someone Walden has known since she was 14 and he was “my friend Lauren’s father.” In summing the deal, Ziffren said what Walden couldn’t in a roomful of closely listening Mouse House lawyers: “Congratulations on getting 100%, and getting it less expensively than others may have thought.” Her quick response: “You said it.” The lawyer-wolves stopped growling and relaxed. Given all at stake, not a word in 55 minutes onstage about possibly succeeding her “most important mentor” Bob Iger later this year, as a visibly nervous Walden relentlessly avoided anything that might stop that train chugging forward. Message discipline. We like that in a major media company CEO. David Zaslav should try it.

Photo by David Bloom.

FRANKEL: Walden and Disney certainly ran down the clock on Charter. But back to my pet “cell-phone internet vs. cable” discussion, T-Mobile and Verizon have massively disrupted U.S. home internet the last three years, amassing 11.2 million FWA customers through Q1, while absolutely stopping in its tracks Big Cable’s growth in high-speed internet — and share price. But I think the end game for the Cell Phone Internet Revolution is simply going to be Big Cable upping its game … and all of us returning to its bosom. Last week, Comcast announced a revised, reinvigorated HSI product line with cheaper prices, whole-home WiFi and no data caps. All it took was a little competition for cable to treat us better.

BLOOM: More forthcoming at UCLA was DeeDee Myers, the long-ago Clinton White House press secretary overseeing California Gov. Gavin Newsom’s revamp of state filming incentives amid a free-fall in local video production. As Myers’ panel unspooled Friday, the Legislature passed and Newsom signed a bill increasing tax incentives from $330 million a year to $750 million. The Lege is expected to take another “huge step forward” this week, passing SB 1138, which nearly doubles the reimbursable percentage of below-the-line costs. It makes incentives available for far more types of productions, including shorter shows (at least 20 minutes long), animation, and the biggest unscripted shows. As other panelists made clear, much more could be done, like including post-production costs, a huge part of many films’ budgets. But the political realities — it’s really a union-backed jobs program for blue-collar union workers — make that unlikely. Post-production houses, for one, generally aren’t unionized, so, no juice. Also, no juice to reimburse what Myers called “the Tom Cruise problem,” i.e., subsidizing above-the-line costs that include multi-million-dollar salaries of possibly wacky movie stars. Myers called SB 1138 “a step toward a better solution.” In a different budget year, more might be possible, she said, but Trump’s TACO Tariff Shuffle turned a projected $6 billion state budget surplus into a $12 billion deficit. Another big issue California can’t fix: the United States has no nationwide filming incentives, unlike many competing countries. Congress can find money to cut trillions of dollars in taxes on aggrieved, overburdened billionaires needing to finance their Venetian weddings/tin-ear triumphal processions, but none for preserving high-value film jobs in this country. Priorities.

FRANKEL: Speaking of the tariff shuffle, Trump on Friday broke off trade negotiations with Canada over its new “digital services tax” — a levy on companies such as Meta, Google and Amazon that make more than $20 million annually in Canada from social media, internet advertising, or online marketplaces. That tax, retroactive to 2022, takes effect Monday and would cost American tech companies up to $3 billion off the bat. On Sunday night, Canada caved to Trump and cancelled the tax.

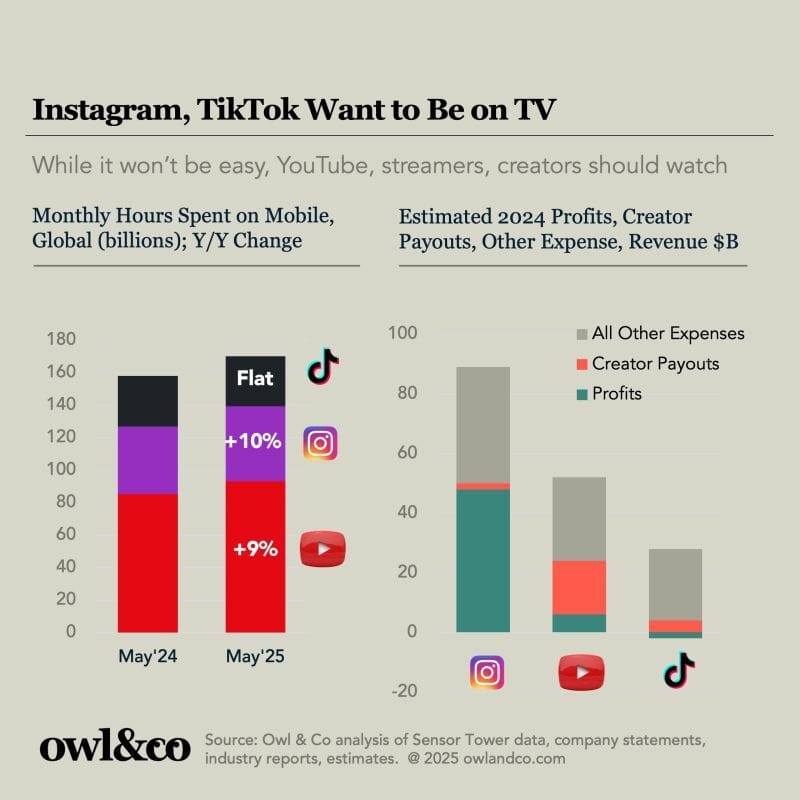

Meanwhile, as recent chatter has focused on YouTube’s exploding connected-TV usage, Owl & Co. suggests the CTV viewership isn’t coming at the expense of mobile, which was up 9% YoY in May. The Information reported that TikTok and Instagram are creating connected TV apps that put their video in the same TV-friendly aspect ratio as YouTube … And it was a decent week for the vertebrae of the news business. Not only did CNN and The New York Times tell Trump to jump in the Persian Gulf when he ordered them to take down stories questioning the effectiveness of air strikes on Iran, but Newsom sued Fox News for $787 million, accusing the network of doctoring an interview — kinda like Trump’s suit against 60 Minutes, but in reverse … and probably with more evidence. (As you may recall, Fox settled a libel suit two years ago with voting machine maker Dominion for the same $787 million figure.) Oh, and 60 Minutes’ correspondents jointly sent a letter to Paramount co-CEO George Cheeks demanding that Tanya Simon, daughter of late correspondent Bob Simon, take over as permanent executive producer. Good to see Shari Redstone took their leaders, but not their spines.

See you in court, @FoxNews.

— Gavin Newsom (@GavinNewsom)

7:24 PM • Jun 27, 2025

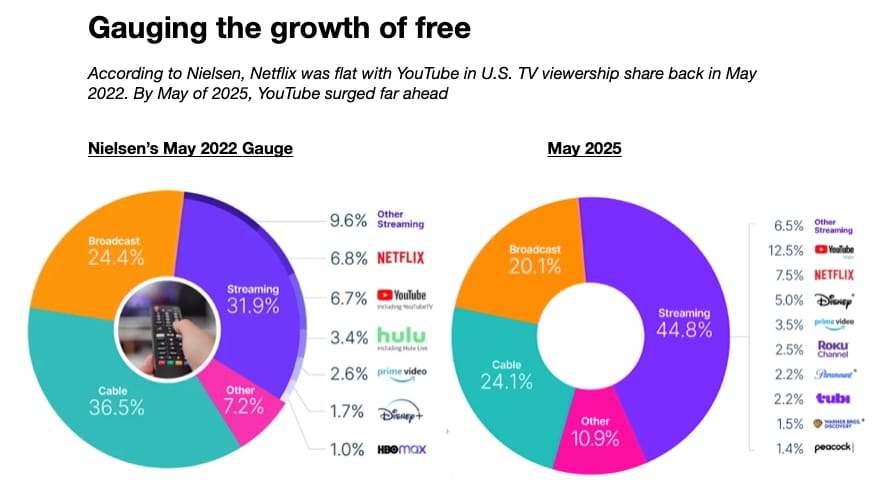

BLOOM: Yet another UCLA session featured Michael Nathanson’s brisk, data-dense presentation on the media landscape, with a coda on AI’s already massive impact: “We don’t want to understate this: We’re at the dawn of a new age powered by generative AI.” I hope everyone paid attention. Other tidbits: Entertainment spending from traditional media companies peaked in 2022. It won’t recover to those levels until at least 2027, and then mostly because of ever-rising sports rights costs, Nathanson said. Non-sports spending will drop 1%, to an industry-wide total of $102.8 billion. That’s a lot of money, but less than flat isn’t great for those new filming incentives. And while theatrical exhibition may be headed to a post-pandemic best box office gross in 2025 ($9.4 billion), something has changed, Nathanson suggested. Even Hollywood’s go-to sequels,. spinoffs and remakes aren’t “finding the traction they had pre-pandemic. In many ways, the hits just aren’t as big.” His thesis: as ticket prices arc skyward, “consumers have gotten smarter.” With so many more-convenient and affordable entertainment options, they pick their spots when it comes to moviegoing. Finally, Nathanson said “the real story of 2025 is the growth of free.” Three years ago, YouTube and Netflix were roughly even in minutes viewed. Now, YouTube is twice as big. “This online world led by YouTube keeps growing, growing, growing. It’s just the monster of all media.”

Separately, Needham & Co. analysts Laura Martin and Dan Medina scanned that Roku-Amazon deal and found several reasons to be upbeat about Roku’s financial prospects. Perhaps most intriguing: this (probably three-year) deal may be a trial run before Amazon buys Roku. After 14 years, Amazon has managed to sell a respectable 118 million Amazon Fire devices. Little ol’ Roku already has 150 million U.S. viewers. So does Amazon buy or build if it wants to lock up the U.S. TV ad market, as it most assuredly does? Seems an easy decision, pending, of course, those “capricious, ideological and decidedly anti-American” regulatory headwinds you mentioned. Combined, Ama-Ku provides the full marketing funnel, from awareness through purchase, a powerful enticement to ad buyers when holiday season rolls ‘round and the partnership fully launches.

FRANKEL: When and if Roku returns to the form of that heady late-July day in 2021 when it peaked at $490 a share, and I treated the family to Bestia here in DTLA … I’ll sell it, run away and never look back. On that note, I wish we could all do that with Knicks and Madison Square Garden empire owner James Dolan, whom Bill Simmons says is trying to block NBA expansion because he doesn’t want to share that $76 billion in national TV rights with more teams. From the looks of this NBA sideline image, I’m not sure too many folks want to share Dolan’s company these days:

MSG mastermind James Dolan signals what defense the Knicks will be in to the Indiana Pacers during a recent NBA playoff game. Image courtesy of Brad Penner-Imagn Images.

Reply