- Next TMT

- Posts

- Netflix launches a risky UX makeover, subscription streaming enters the upfronts on an ad-supported roll, and FWA could run out of spectrum next year

Netflix launches a risky UX makeover, subscription streaming enters the upfronts on an ad-supported roll, and FWA could run out of spectrum next year

Also in our weekly newsletter covering all things technology, media and telecom, we ponder whether Donald Trump is serious about 100% foreign-movie tariffs, and why David Eilenberg is leaving Roku for his old job

Ad-supported plans take over the suddenly thriving U.S premium SVOD business

As last week’s earnings reports revealed, subscription streaming is profitable … or for some, almost profitable. From password-sharing crackdowns to bundling, as “Next Text” further on in this newsletter mentions, a number of factors helped end the massive losses hitting Disney, Warner Bros., Paramount, NBCUniversal and another media companies the past several years.

But as the video business heads into upfront week in New York this week, maybe the biggest source of economic turnaround has come from the emergence of cheaper, ad-subsidized tiers.

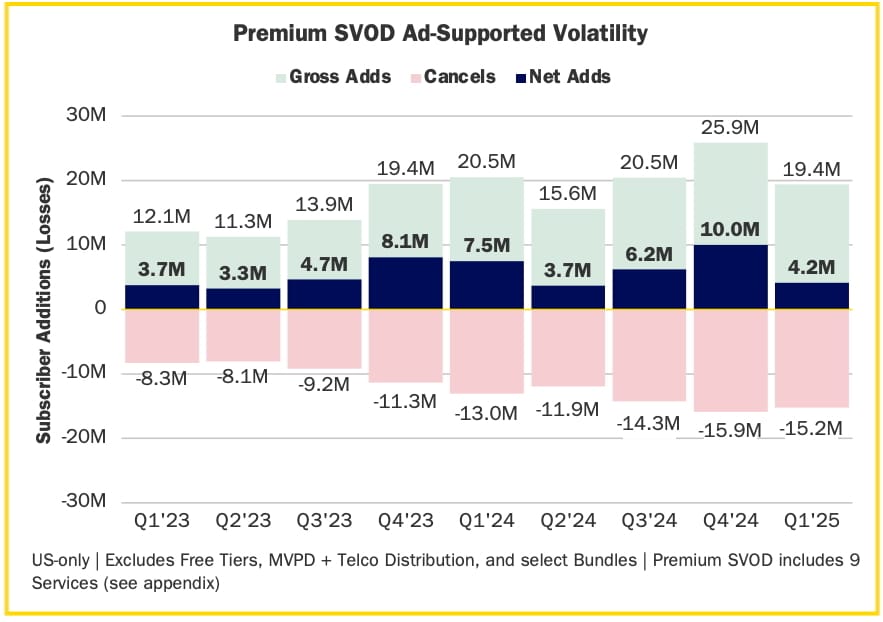

According to research company Antenna, ad-supported plans drove 71% of premium SVOD net additions between the first quarter of 2023 and Q1 of 2025. Out of 71.8 million net adds, 51.4 million were for less expensive “basic with ads” tiers. And over the past four quarters, ad-supported plans have averaged around 6 million net additions.

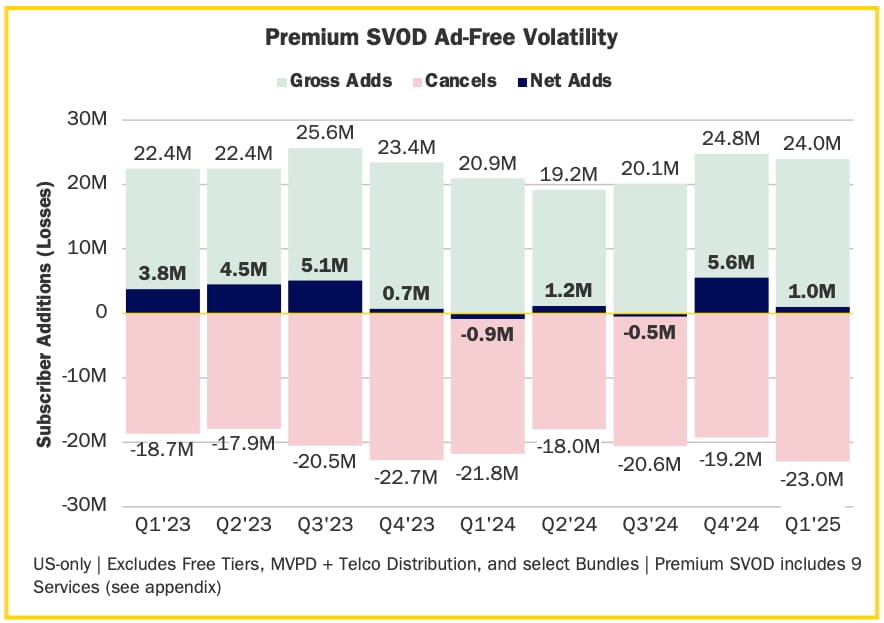

Courtesy of Antenna.

Conversely, churn for premium ad-free plans has been much higher. Over the last year, these zero-commercial SVOD services have averaged only 1.825 million additions per quarter.

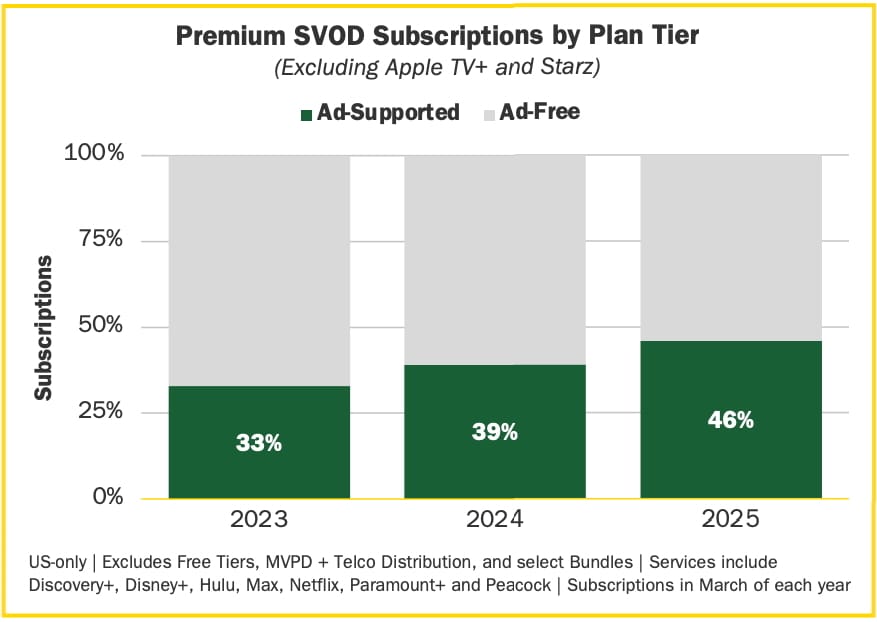

Nearly half, 46%, of premium SVOD customers are now on ad-subsidized plans, according to Antenna, up from 33% just two years ago. Sixty-five percent of ad-supported users are folks who never signed up for the platform, meaning the less expensive plans are lowering barriers to SVOD entry.

The data is part of Antenna’s upcoming Q2 “State of Subscriptions” report, which will be published in full later this month.

— Daniel Frankel

Your direct connect to the decision-makers

With an open rate averaging more than 60%, Next TMT is a Monday-morning “must read” for top-level executives in streaming, ad tech, AI, cable, wireless, gaming and related sectors.

Want to get in on the ground floor of this exciting new sponsorship opportunity, and support independent journalism in the process? Well, we know somebody who knows somebody who knows somebody.

Visit our sponsorship portal to directly book a newsletter sponsorship, or reach out to [email protected] to discuss block discounts, custom videos and other options.

Next Text: A Qwik look at Netflix’s new homescreen, Hollywood’s boffo streaming profits, and Trump’s bananas (and unserious) foreign-movie tariffs plan

Our weekly text exchange between veteran reporters David Bloom and Daniel Frankel also examines an interesting new data-privacy lawsuit against Roku

DANIEL FRANKEL: Well, D., if you’ve been around the media biz like we have, you know that when Netflix changes something, it can be big news. Like that time 14 years ago when it spun off its DVD business into a short-lived entity known as “Qwikster,” plunged its stock price 30% in one day, and drove off 800,000 subscribers. Now, with its global user base about 15 times larger, Netflix begins rolling out a new connected-TV user interface that, according to Chief Product Officer Eunice Kim, will be less like scrolling an endless sea of box art at Blockbuster Video, and, at least ostensibly, more interactive and intuitive. Admittedly, referencing the ancient Qwikster debacle is a pretty negative direction for me to choose go — the UX needs to evolve. But this is a big change that does carry some risks.

Netflix has been working on this UX redesign since 2022, rethinking a user experience that has, even with myriad updates, largely been static since 2013 … when Netflix only had around 30,000 streaming subscribers. Today, with more than 301 million subscribers globally and more than 700 million total users, Kim’s team faces a ton of pressure to get this right. “No entertainment company has programmed with this ambition before, for this many tastes, cultures and languages,” she says in the presentation below. I definitely will test drive this new UX. A creature of habit, I’ll try not to be Qwik to judge.

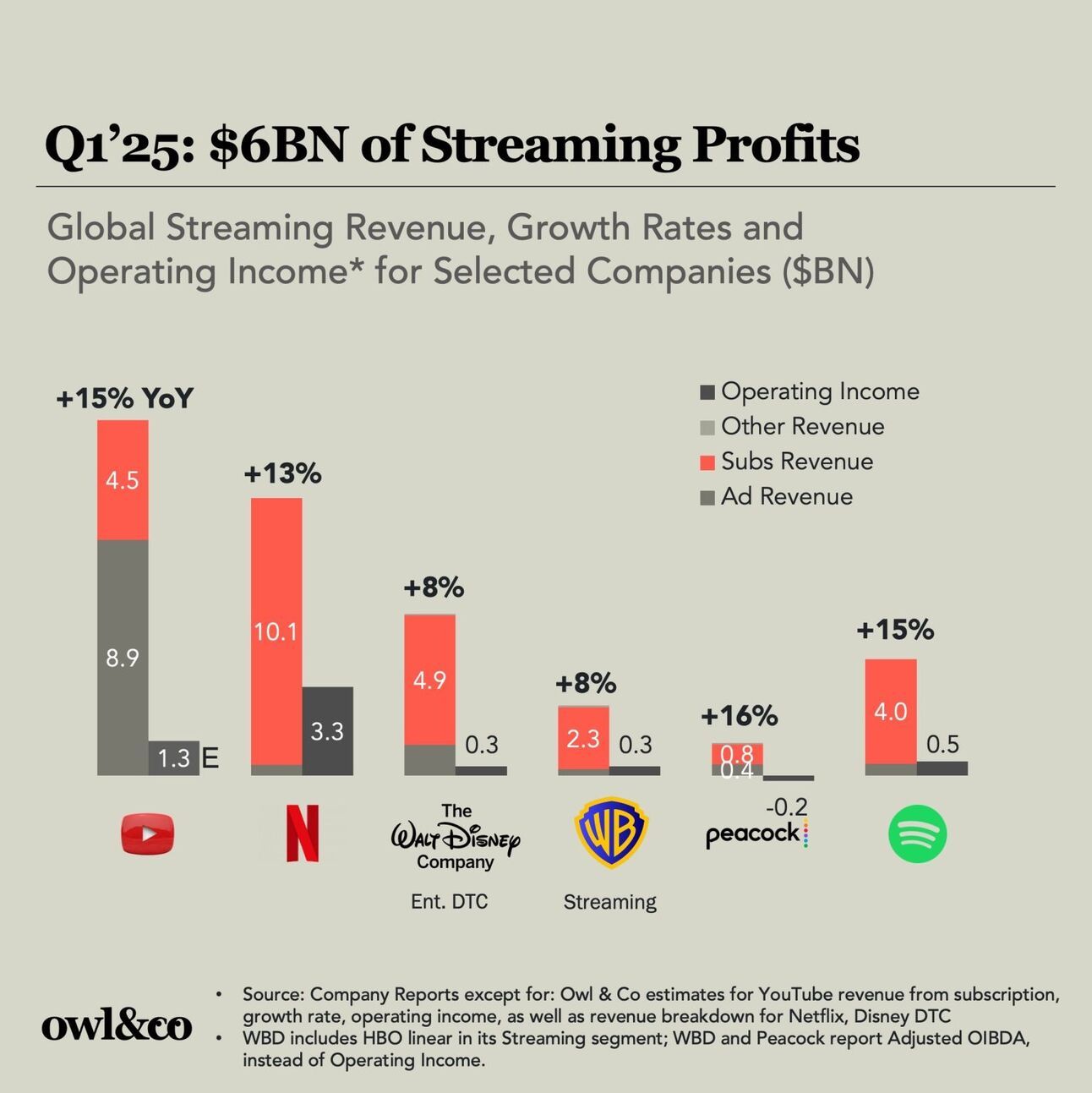

DAVID BLOOM: Your fusty resistance to change is part of your ineffable charm, Daniel. Netflix’s UI makeover is way overdue, and some indeed will squawk about any change to this newfangled thingamabob. I’m more interested in: 1) how the redesign better showcases newer Netflix content types such as live events, sports and video games, and 2) how they’ll eventually fine-tune their ad-supported experience, a key to future revenue growth. For now, Kim and Chief Technology Officer Elizabeth Stone said you won’t see much difference between ads and ad-free, but for how long? Does Netflix’s ad tier ever start leveraging money-makers such as home-screen display ads, like Roku? Elsewhere, good news for formerly limping SVOD operators: they’re making money! Owl & Co’s Hernan Lopez, formerly a Fox TV exec and CEO of audio company Wondery, posted this on LinkedIn this week:

A collective $6 billion in profits from streaming video suggests (with some educated guesses) that nearly everyone is turning the corner. “All companies in the space have reported significant increases in operating income or EBITDA compared to a year ago,” Lopez wrote. “Netflix still leads the pack with $3.3B in profits, but YouTube, Disney, WBD and Spotify have collectively brought in $2.5B by my estimate (including YouTube, which doesn’t break out operating income or sub revenue).” Paramount+ lost a couple of hundred million dollars, sure, but even that’s a big improvement. Separately, Lopez hasn’t modeled Prime Video, “but industry sources suggest they’re also in the black.” Multiple strategies helped: bundles, ad-supported tiers, password crackdowns, international expansion, etc. Maybe that light at the end of the tunnel is blue skies, not an onrushing train: “When you're crossing the line from losses to profit in a largely fixed-cost business, improvements can come relatively fast.”

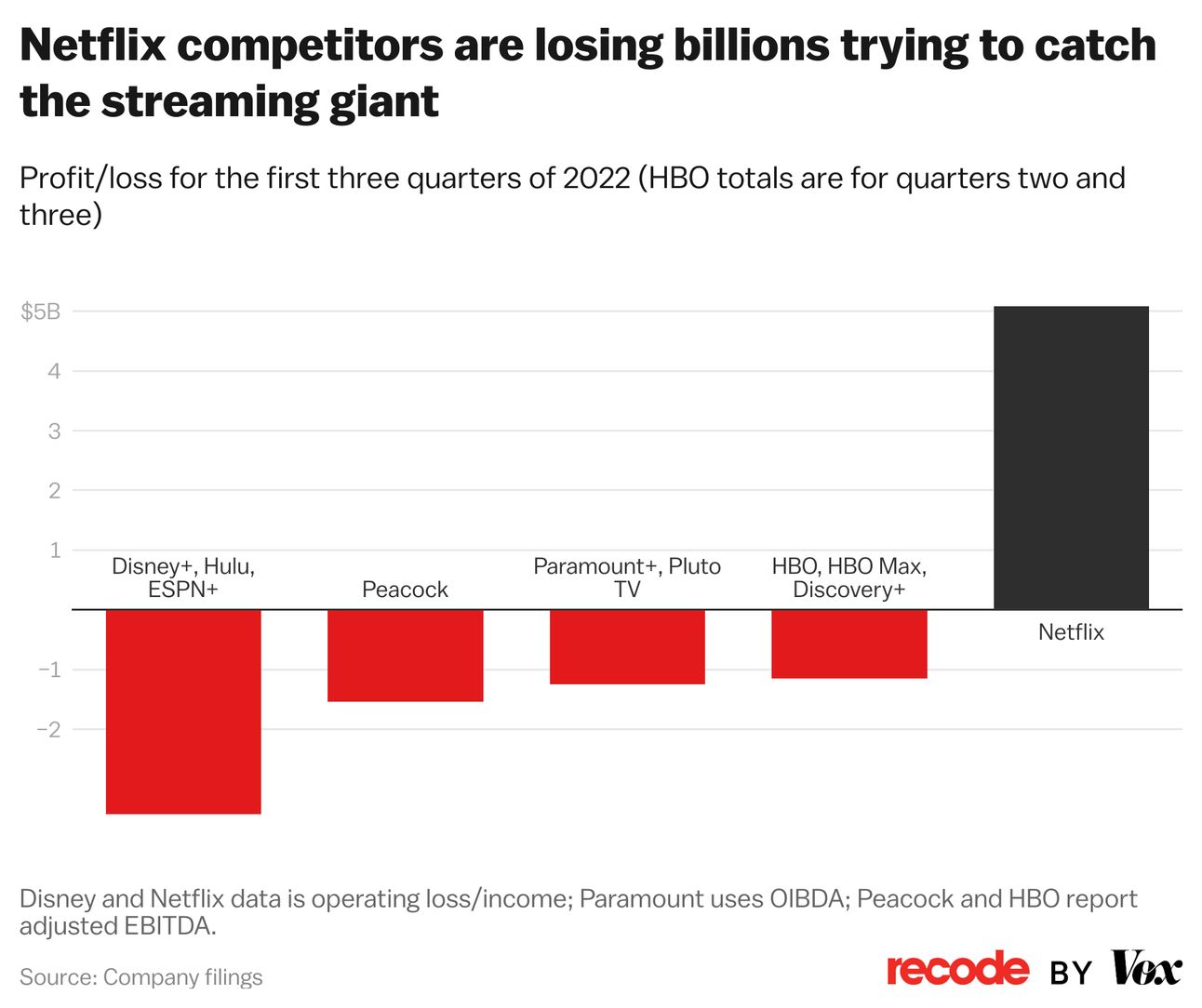

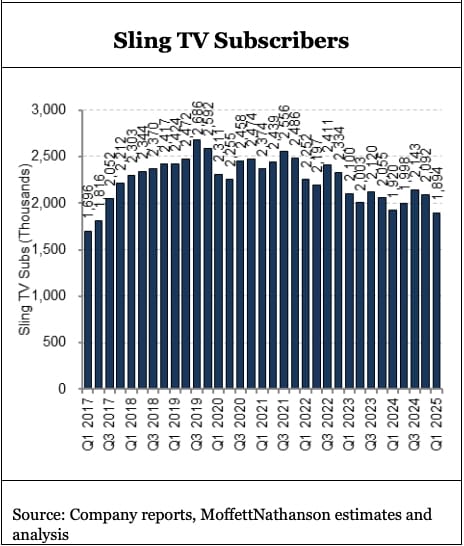

FRANKEL: To be more specific, Paramount’s DTC losses in Q1 totaled only $109 million, a 62% YoY reduction. The turnaround is remarkable, especially when you consider the narrative on SVOD just three years ago, as the graphic above shows. It was around this time that investors, suddenly awakened from the pandemic fog of the streaming wars, realized how expensive it was to launch these platforms and freaked out, sending share prices plummeting. Disney lost $11.4 billion on streaming from Disney+’s launch in November 2019 through April 2024. Just nine months later, in Q1, Disney generated a $336 million Q1 profit from Disney+, Hulu and ESPN+. Meanwhile, The White Lotus and The Pitt helped Warner Bros. generate a Q1 streaming profit of $339 million. Speaking of earnings, The Trade Desk patched up its fourth-quarter tiff with Wall Street. TTD stock rose nearly 25% after the biggest publicly traded advanced advertising company reported a 25% Q1 revenue bump. Not so at EchoStar, which continued its inexorable slide toward Chapter 11 oblivion. Not even Sling TV is growing anymore, losing nearly 200,000 subs in the first quarter.

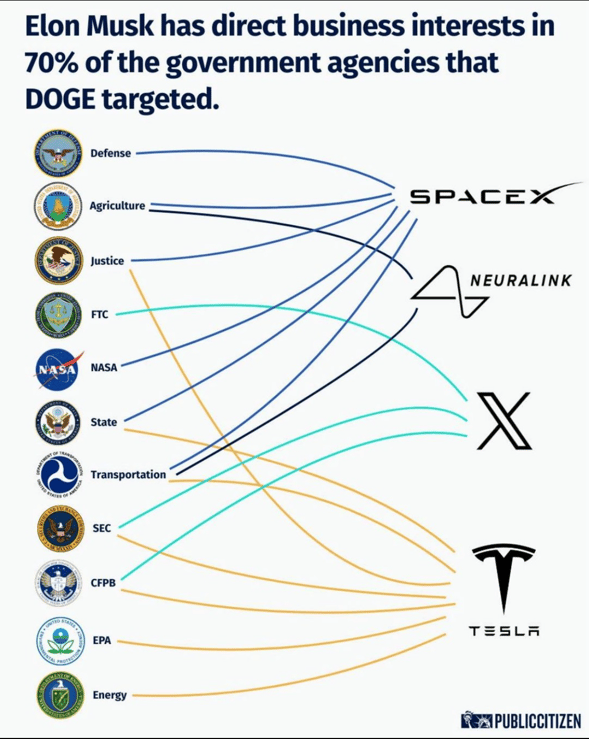

BLOOM: Amid the good news there have still been headaches, as when Our Only President posted online his ill-formed plan to impose 100% tariffs on foreign-made films. No one, apparently including OOP, knows what that means for an intensely international industry that derives two-thirds of its revenue overseas. U.S. Rep. Laura Friedman, a Democrat whose Los Angeles County district includes several major studios, told CNBC on Friday what pretty much everyone in the industry is saying: “Huh?”

At a panel I moderated Tuesday on entertainment investing, similar confusion reigned. One veteran film producer said it’s hard enough cobbling together financing, script, stars, director and the rest. Adding tariff uncertainties for months to come will only make it harder. But give Trump credit for saying he only wants to save good American jobs. Amen to that. One panelist, East Beach Capital partner E.J. Kavounas, noted that related proposals sent to Trump from actor Jon Voigt, Trump’s “special ambassador” to Hollywood, and Voigt’s manager include a nationwide rebate for films shot in the United States. California, Georgia and some other states have filming incentives, and California Gov. Gavin Newsom is expected to propose more than doubling Cali’s incentives to $750 million a year. But the U.S. doesn’t do enough nationally to preserve a world-famous industry that runs a trade surplus, generates lots of blue-collar jobs, and efficiently projects U.S. soft power. Instead, other countries offer big incentives, and media companies go shopping for lower-cost ways to make shows. That said, passing tax giveaways for rich, amoral Hollywood scum (as opponents typically characterize such filming incentives) won’t be easy. I’ve been writing about runaway production for 30 years, and the political realities are fraught. We’ll see what wins out amid the job apocalypse in L.A.’s entertainment business.

Please CLICK ON OUR SPONSOR’S AD below. It’s easy to do. There’s no commitment involved. And the resulting monetization will help us keep committing this act of weekly journalism. Thank you.

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

FRANKEL: I believe the OOP announced (thought up?) 100% movie tariffs the same day he touted the economically infeasible recommissioning and geographically impossible expansion of Alcatraz. Trump’s second term has been distinguished by a lack of adult supervision, the bad ideas surfacing as unfortunate actual policy. But I suspect import taxes on video is just more “flooding of the zone.” The vibe coming from D.C. is that he isn’t serious about this particular import tax. Of course, regardless as to whether the bad ideas ultimately stick or not, there’s always an impact.

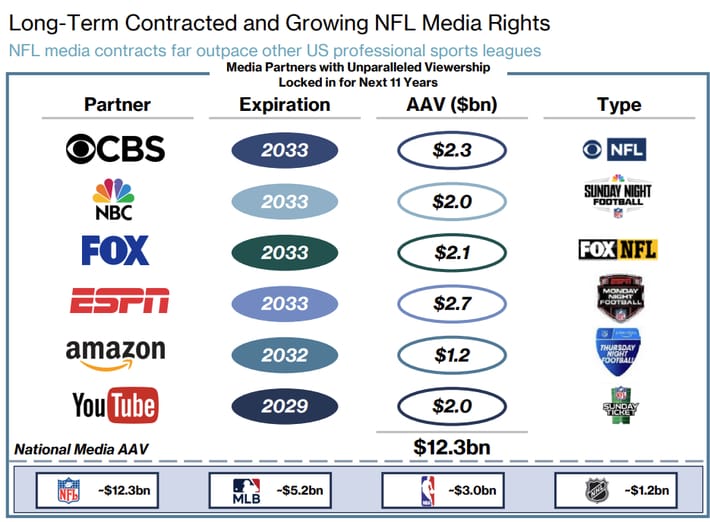

In any event, Google and the NFL don’t seem worried, as they slice up another piece of league TV rights. In yet another expansion of their NFL partnership, the world’s biggest video platform – free, ad-supported YouTube – is reportedly close to a deal to live-stream the annual week 1 game in São Paulo, Brazil. This year, the likely matchup pits the Super Bowl runner-up Kansas City Chiefs against the San Diego Chargers. Sports Business Journal reports that YouTube would probably pay even more than the $105 million NBCUniversal and Peacock coughed up for the Brazil game last year.

Courtesy of Forbes.

BLOOM: And so the next stage of the tech giants’ sports takeover moves apace. The real bidding war will be for an 18th regular-season game, which doesn’t exist yet. The NFL Players Association almost certainly will sign off once the league gives them bigger rosters and more money. Elsewhere, here’s something you won’t see again soon: the interactive Bandersnatch episode of Netflix’s creepily prescient Black Mirror. Bandersnatch was revolutionary in 2018, suggesting a choose-your-own-adventure TV future. Now, like some Black Mirror plot, that future is dead. What will the next generation of interactive “TV” look like? Perhaps a next-gen extension of Netflix’s billions of dollars in game investments. And Netflix’s new user interface? What a great future showcase for the next generation’s Bandersnatch.

One last thing: Neil Young was a grumpy old hippy even when he was, er, young, but over the past six decades, he’s written some damned fine protest songs (among so much else). His banging new single Let’s Roll Again begs GM, Ford, and Chrysler “to build somethin’ useful” that “runs real clean” to catch up with what the Chinese are making. Oh, and “If yer a fascist, then get a Tesla. If it’s electric, it doesn’t matter.” Thus, the Toronto-born son of a journalist, six months from his 80th birthday, wraps up yet another barn-burnin’ report from at least three different sets of political front lines.

FRANKEL: I’ll give ol’ Neil a listen when we finish this column. Speaking of finished, unscripted programming wiz David Eilenberg, whom Roku poached from ITV America three years ago to head its content efforts, is returning to ITV America as creative director. ITV America has backed reality hits including Love Island USA, Queer Eye, Hell’s Kitchen, The Voice and The Real Housewives of New Jersey. Eilenberg had a big job programming what is now the biggest name in FASTs, the Roku Channel. I interviewed him most recently on March 31, and covered a ton of ground: FASTs’ growth, YouTube’s dominance, ad-supported SVOD’s emergence. I came away impressed with Eilenberg’s insights and depth of video-business knowledge. He’s one of the sharper TV execs you’ll meet, but I never felt like he had much budgetary rope to work with at Roku. Anyway, interesting retrograde move. And speaking of Roku and interesting, a Michigan attorney has filed suit, alleging Roku violated the federal Children’s Online Privacy Protection Act (COPPA). The complaint accuses Roku and its vendors of collecting and processing children’s personal information, including voice recordings, location data, IP addresses and browsing histories. Good to know that on Peacock hit Love Island USA, you only get served with slushy cocktails, not lawsuits.

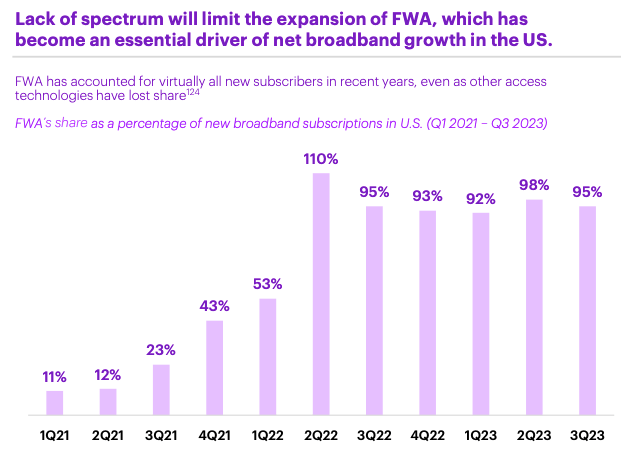

While the courts weigh the future of digital privacy, wireless lobbyist the Cellular Telephone Industries Association (CTIA), now led by former FCC Chair Ajit Pai, is pushing the federal government to release more spectrum. A new CTIA report by Accenture says that applications such as fixed wireless access will run out of spectrum next year unless the feds do something. Of course, creating panic helps Pai and CTIA do what they do. But FWA services from T-Mobile, Verizon and more recently AT&T have dominated residential broadband subscriber growth (while decimating cable company share prices) since 2022. The growth could stop if spectrum hits hard capacity limits (LightReading has a typically solid deep dive on spectrum issues here.) Notably, Altice USA — an MSO hit hard by fixed wireless competition — last week announced FastPass, a $25-a-month, 100 megabits-per-second-downstream service. After years of dismissing FWA as a passing fad, cable companies are finally doing something to compete with “cellphone internet.”

Courtesy of Accenture.

Please CLICK ON OUR SPONSOR’S AD below. It’s easy to do. There’s no commitment involved. And the resulting monetization will help us keep committing this act of weekly journalism. Thank you.

You Don’t Need to Be Technical. Just Informed

AI isn’t optional anymore—but coding isn’t required.

The AI Report gives business leaders the edge with daily insights, use cases, and implementation guides across ops, sales, and strategy.

Trusted by professionals at Google, OpenAI, and Microsoft.

👉 Get the newsletter and make smarter AI decisions.

Reply